Some areas that a DMM can assist in financial responsibility include:Ī professional daily money manager in the DC Metro Area or Charlottesville, VA can not only keep an eye on your assets, but also prevent you from making money missteps, help you understand complicated bills, as well as helping to guard against identity theft, money scams, or other signs of abuse or fraud. Their budgeting tool is able to analyze your monthly income, categorize areas of overspending, and provide a budgeting process that is easy and simple from month to month.

#MONTHLY EXPENSE TRACKER HOW TO#

How to Use a Budget Tracker from a Daily Money Management ProgramĮssentially, a DMM can be considered as a personal money assistant. We help senior citizens take advantage of living in Charlottesville, VA and the DC Metro Area. Things like taking part in familiar hobbies and activities, making charitable donations to organizations they support, and giving gifts to loved ones can make a senior feel a comforting sense of independence.

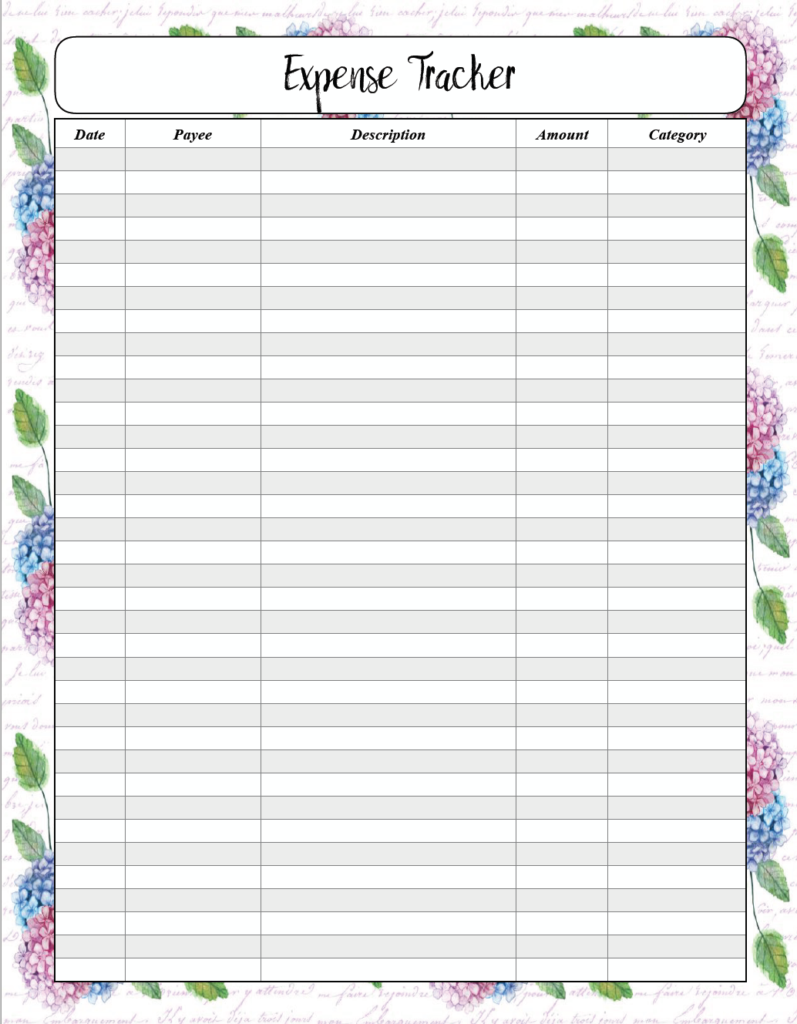

It ensures that they are able to pursue the freedoms of what they love for as long as they are financially able. A budget tracker and personal expense tracker managed by a professional also enables individuals to have a sense of independence with their income and expenses. A professional financial assistant then creates a budget to allot for all areas, as well as helping to maintain a personal expenses tracker and emergency fund.īy creating a budget and spending plan, Help Unlimited is able to alleviate concern and provides peace of mind for seniors and busy professionals when it comes to paying their daily and monthly expenses. When budgeting, financial areas such as housing, repairs, food, dining out, personal care, medical expenses, insurance, taxes, home care, and other miscellaneous expenses are all taken into consideration. There are many different types of budget tracking programs, such as those developed by Help Unlimited’s Daily Money Managers, that are designed to help busy professionals as well as seniors manage and monitor their financial responsibilities. Budget tracking or personal expense tracking are two ways to help maintain the lifestyle that seniors have become accustomed to during their lifetimes, providing budgeting tools to track your income and expenses. Things as simple as going out to eat in DC, going on a shopping spree or taking a vacation may all be too expensive when piled on top of living expenses unless steps towards daily money management have been taken.

As seniors mostly live off of social security, pensions, or investments, budgeting and expense tracking become integral parts of everyday life. When it comes to senior living and retirement in Charlottesville, VA and the DC Metro Area, financial planning takes on a whole new sense of importance.

0 kommentar(er)

0 kommentar(er)